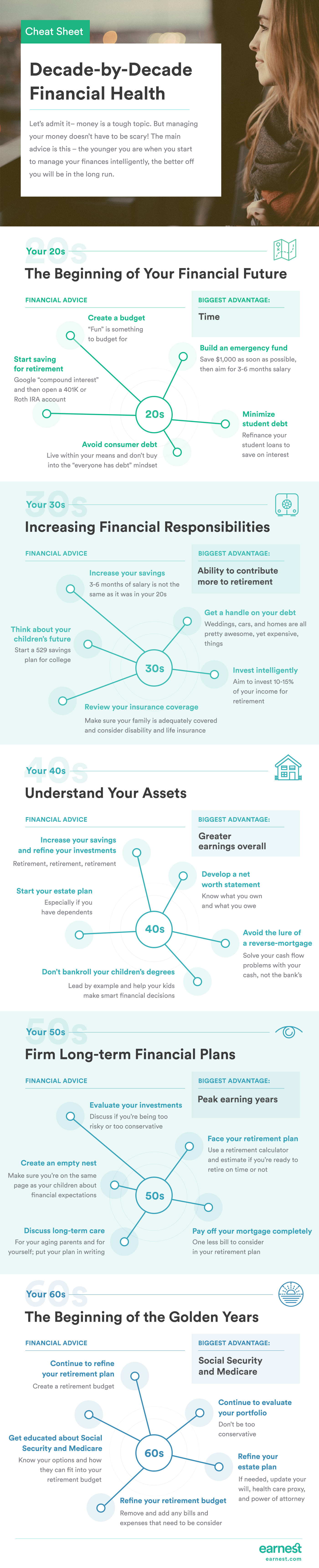

Thinking about your financial future can be a scary thought. From setting a budget for yourself, to planning out how much money you should set aside and when, to knowing how much should be in your savings account, it can all be very stressful. The folks at Earnest have created a guide broken down decade-by-decade that shows what you should be doing to save money in each age range. From refinancing your student loans to evaluating your investments, there are many things you can do starting out in your early 20s to help get you on the path to a successful financial future. It’s never too early or too late to start saving money and with the guide below you can see exactly what you need to do to get to where you would like to be financially.

Speak Your Mind